If you die and your spouse/partner remarries, the new spouse could end up getting the house and your children could get nothing.

Couples (married/unmarried) with children from different relationships. With a protective property trust each spouse/partner can decide who will benefit from their share of the value of the home (normally 50%) which will be held on trust for them until after the second death. Without this trust in place, there is a real risk that some children/stepchildren could end up with nothing.

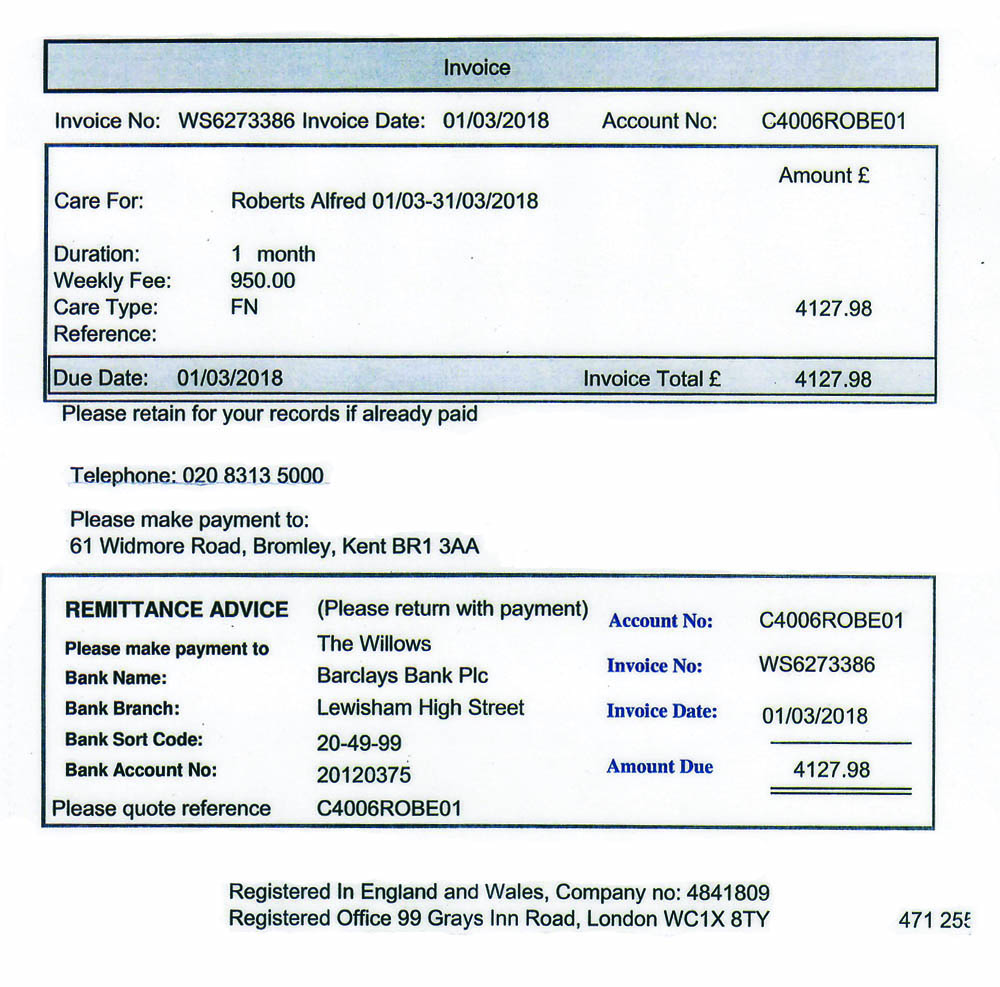

Selling the family home to pay for care home fees. If a couple own a house as beneficial joint tenants, under a standard will, on first death the survivor will normally inherit 100% of the family home. If the survivor, then needs long term care the local authority can then put a charge on the home to pay for care. This could mean your beneficiaries end up with a reduced inheritance or in some cases nothing at all, depending on the length of time in care. So how does a protective property trust work? In simple terms, the trust works by making sure the surviving spouse never owns 100% of the property. On first death it will state that the first to die does not leave his/her share of the property (normally 50%) to the survivor. It will pass into a trust (held by your nominated trustees).

It does however specify the following:

- right to occupy the home for the surviving spouse for the rest of their life

- right to downsize or move if needed

- each spouse can be named as a trustee of the protective property trust.

If the local authority assesses what the surviving spouse owns, they cannot take into account what has already passed into trust (normally 50%) so they can consider half the value of the home, not all of it.